Lending with Empathy.

Growing with Purpose.

Financial access with empathy, accountability,

and real impact.

Our Offerings

Products

Income Generating Loan

Under JLG and IL model for income generating activities

Loan size – Rs. 10,000 – 1,00,000

Micro Enterprise Loan

This is the IL Product which will be offered largely in urban locations to the individual who have either fixed business setup or dwelling

Loan Size – Rs. 50,000 – 1,50,000

Petty Trader Loan

Urban petty trader and street vendors who have ability to pay digitally are aimed under this product

Loan size Rs. 10,000 - 25,000

Consumption Loan

This product will be offered to only existing customer of the company to fulfill their various consumption needs including health, education, emergencies etc.

Loan Size – Rs. 10,000 – 25,000

Pricing Details

on Income Generating Loan

Interest to be charged: 27% on declining balance method

Processing fee to be charged : 2% of Disbursed Loan amount

No Prepayment Charges & No other Hidden Charges.

MD & CEO - Mr. Trilok Nath Shukla's Vision Behind Samvedna

Founded Samvedna Microfinance Pvt. Ltd., with clear vision in mind — to create meaningful financial access for people who are often left behind by the traditional banking system. After spending years working in the financial sector and witnessed, how rural and low-income individuals either in rural or urban areas face overwhelming barriers to simple financial services.

What moved me most were the stories of resilient women,and first-time entrepreneurs — all working tirelessly for a better life, yet held back by the absence of fair and supportive financial systems.

Samvedna was born from that understanding — not merely to offer loans, but to walk alongside people who aspire to grow. Our purpose is not just to enable, but to empower. Through microloans, financial literacy, and a human-centered approach, we’re helping individuals build their futures with confidence and self-reliance.

Every product we design, every team we nurture, and every life we serve is anchored in three core values: empathy, accountability, and impact.

“At Samvedna, we measure success not only in numbers”.

MD & CEO

Samvedna Microfinance Pvt. Ltd.

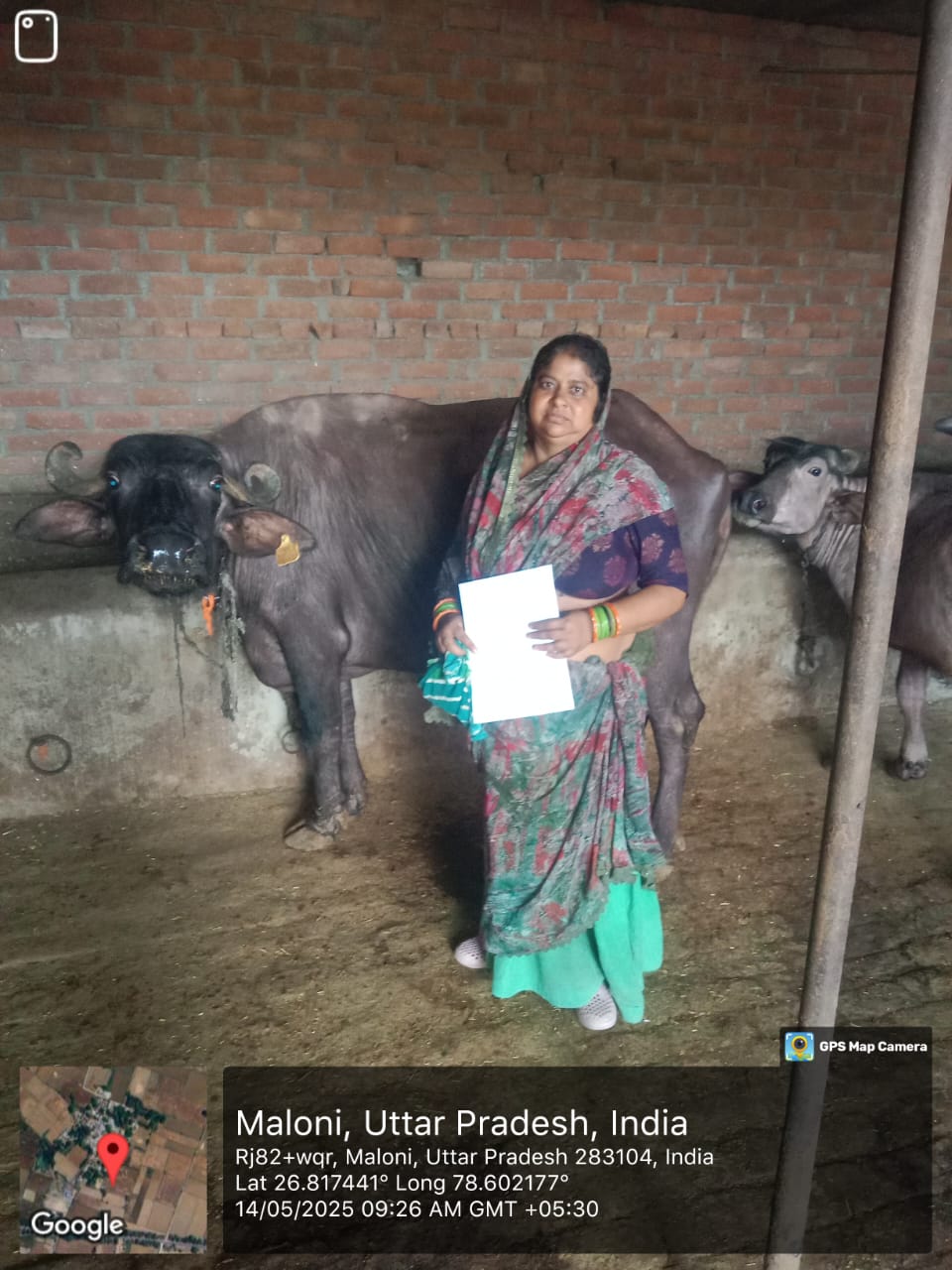

Client stories

"Been with Synox for years, couldn't be happier. Their tailored plan expectations. Thanks to their guidance, my portfolio grew significantly."

Hawthorn Sage

Our Investors"Choosing Synox was one of my best decisions. Their transparent approach and regular keep and reassured about my investments."

Reynolds Anthony

Our Investors"I've worked with many firms, but none impressed me like Synox. Their expertise and commitment. I trust them with my financial future."

Rosemary Violet

Our Investors"Been with Synox for years, couldn't be happier. Their tailored plan expectations. Thanks to their guidance, my portfolio grew significantly."

Hawthorn Sage

Our Investors"Choosing Synox was one of my best decisions. Their transparent approach and regular keep and reassured about my investments."

Reynolds Anthony

Our Investors"I've worked with many firms, but none impressed me like Synox. Their expertise and commitment. I trust them with my financial future."

Rosemary Violet

Our InvestorsOur Impact

Branches

Empowered

Disbursement

Region

Covered

Outstanding

Prospects of Coverage Area

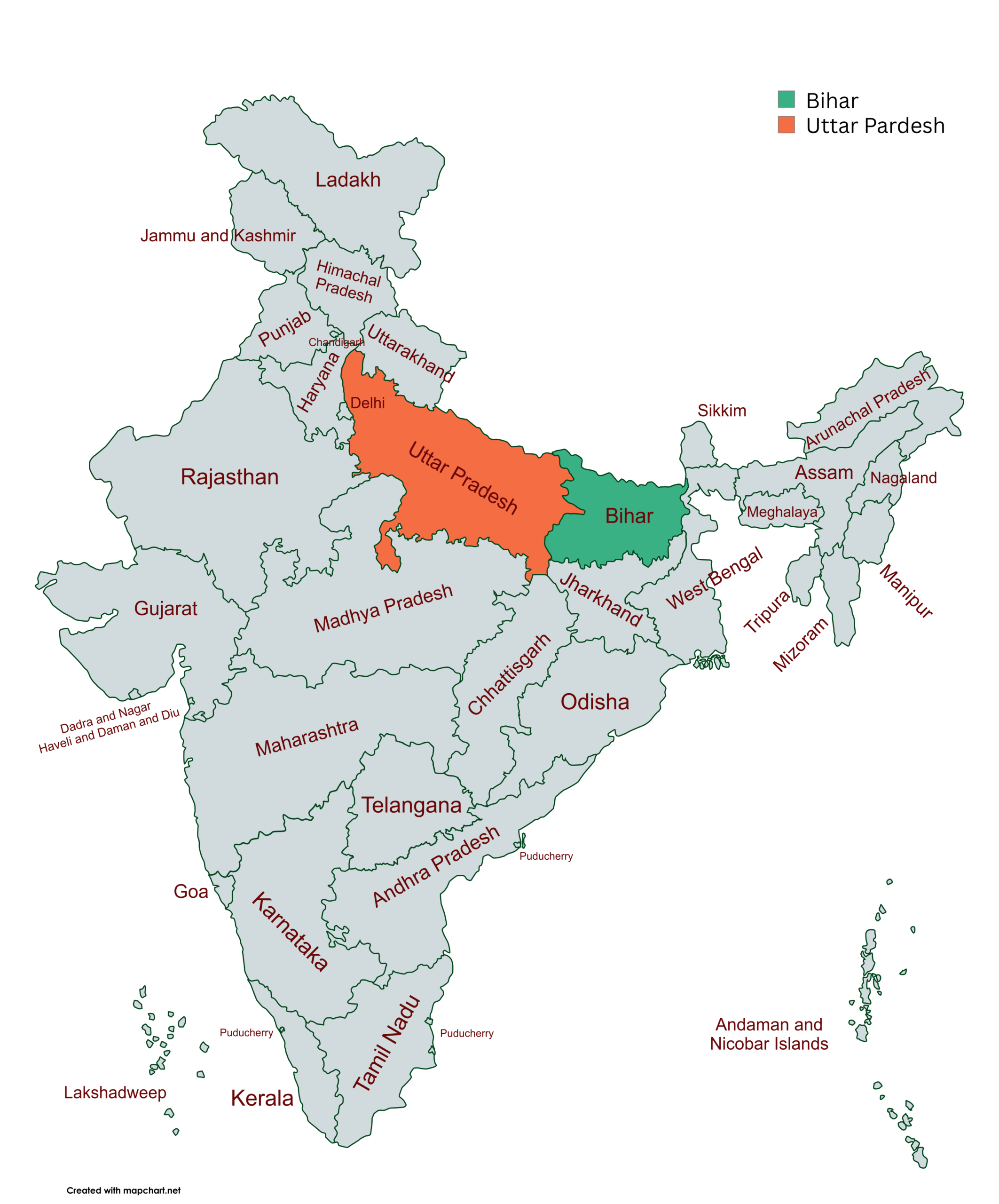

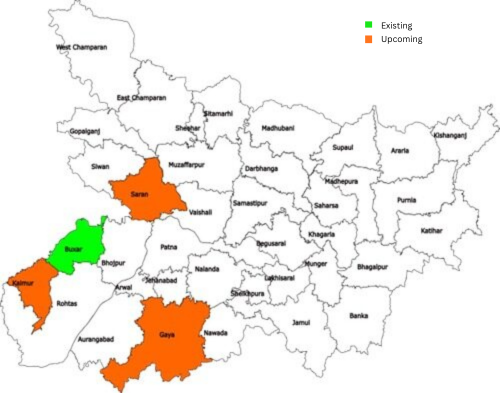

Samvedna is deeply rooted in the heartland of India, we are operating across key districts of Uttar Pradesh — including Agra, Mathura, Aligarh, Bulandshahr, Amroha, Sambhal, Firozabad, Budaun, Bareilly, Jhansi, Jalaun, Hamirpur, Moradabad, Auraiya, Etawah, Mirzapur, Ghazipur, Jaunpur and Chandauli — as well as Buxar and Saran in Bihar. These regions are home to thousands of hardworking individuals and aspiring entrepreneurs whom we proudly serve every day.

As part of our continued growth, we are expanding our presence into new and promising regions, including Sant Ravidas Nagar, Pilibhit, Shahjahanpur, Farrukhabad, Mahoba, Lalitpur, and Banda in Uttar Pradesh, and Kaimur and Gaya in Bihar, bringing accessible and responsible financial services to more underserved communities.

Looking ahead, our vision is bold and inclusive. Over the next five years, Samvedna aims to establish a strong presence across Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, and Rajasthan — enabling financial empowerment at scale and fostering economic resilience in underserved regions.

Samvedna is deeply rooted in the heartland of India, currently operating across key districts of Uttar Pradesh — including Agra, Mathura, Aligarh, Bulandshahr, Firozabad, Bareilly, and Jhansi. These regions are home to thousands of hardworking individuals and aspiring entrepreneurs whom we proudly serve every day.

As we continue to grow, our reach is expanding into new and promising territories such as Budaun, Pilibhit, Shahjahanpur, Hamirpur, Farrukhabad, Mahoba, Lalitpur, and Banda, bringing accessible and responsible financial services to more communities.

Looking ahead, our vision is bold and inclusive. Over the next five years, Samvedna aims to establish a strong presence across Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, and Rajasthan — enabling financial empowerment at scale and fostering economic resilience in underserved regions.

Samvedna is deeply rooted in the heartland of India, currently operating across key districts of Uttar Pradesh — including Agra, Mathura, Aligarh, Bulandshahr, Firozabad, Bareilly, and Jhansi. These regions are home to thousands of hardworking individuals and aspiring entrepreneurs whom we proudly serve every day.

As we continue to grow, our reach is expanding into new and promising territories such as Budaun, Pilibhit, Shahjahanpur, Hamirpur, Farrukhabad, Mahoba, Lalitpur, and Banda, bringing accessible and responsible financial services to more communities.

Looking ahead, our vision is bold and inclusive. Over the next five years, Samvedna aims to establish a strong presence across Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, and Rajasthan — enabling financial empowerment at scale and fostering economic resilience in underserved regions.

Why People Should Trust Us

At Samvedna, trust isn’t something we ask for — it’s something we earn every day through our actions, values, and commitment to the people we serve.

Our journey began with a simple but powerful insight. Samvedna is driven by the belief that dignity, opportunity, and trust should be at the heart of every financial relationship.

Trusted by 100k+ Investors

Strive for Excellence

“We are committed to continuous improvement & achieving the highest standards in everything we do. Excellence is our benchmark”

Honesty & Integrity

“We uphold the highest ethical standards in all our actions. Transparency, honesty, and integrity guide our decisions and behavior.”

Innovation & Creativity

“We foster a culture of innovation, encouraging fresh ideas and creative solutions to meet challenges and drive growth.”

Nurturing Relationship

“We value relationships and treat everyone with respect and empathy. Building strong and enduring partnerships is at the core of our business.”

Empowerment & Accountability

“We built a culture of empowering people to take independent decisions under the purview of vison & mission of the company & own them.”